PARTNER NETWORK

Tiger Woods Foundation

North America

$13,588,753

$11,830,471

87.00%

9.02 Years

Mission

Use Placeholder Paragraph

Financial Summary

Program Expenses:

$69.1% ($9,390,848)

Total Expenses:

87.1% ($11,830,471)

Fundraising Efficiency:

0.13

Working Capital:

9.02 Years

Expense Growth:

11.3%

Revenue Growth:

7.8%

Liabilities to Assets:

10.5%

Income Statement Summary

(FYE 09/2018)

REVENUE

Contributions

Contributions, Gifts & Grants

$3,662,820

Federated Campaigns

$6,570

Membership Dues

$0

Fundraising Events

$0

Related Organizations

$3,913,550

Government Grants

$0

$7,582,940

$37,055

$7,619,995

$5,968,758

$13,588,753

EXPENSES

Program Expenses

$9,390,848

Administrative Expenses

$1,692,124

Fundraising Expenses

$747,499

$11,830,471

$0

$1,758,282

$99,416,921

Administrative Compensation

(FYE 09/2018)

$154,500

1.30%

Rick Singer

President, CEO

$443,800

$231,780

1.95%

Jin Thatcher

VP Operations & Administration

0

$217,400

1.83%

Katherine Bihr

VP Programs & Education

0

$186,800

1.57%

Michelle S. Kim

VP Strategic Partnerships

0

Other Salaries of Note

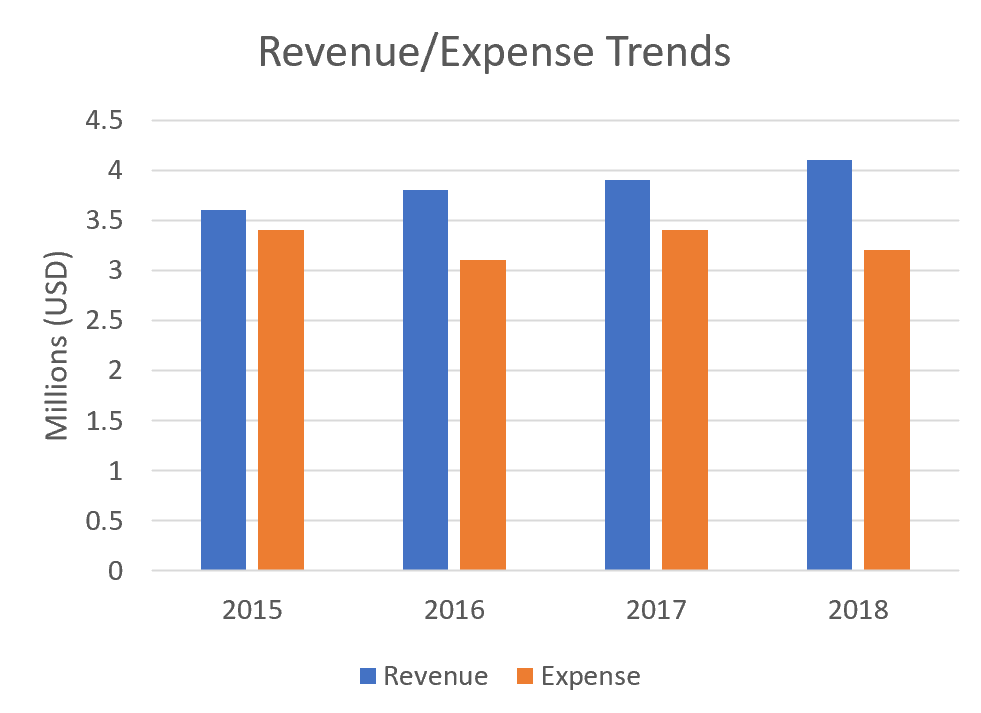

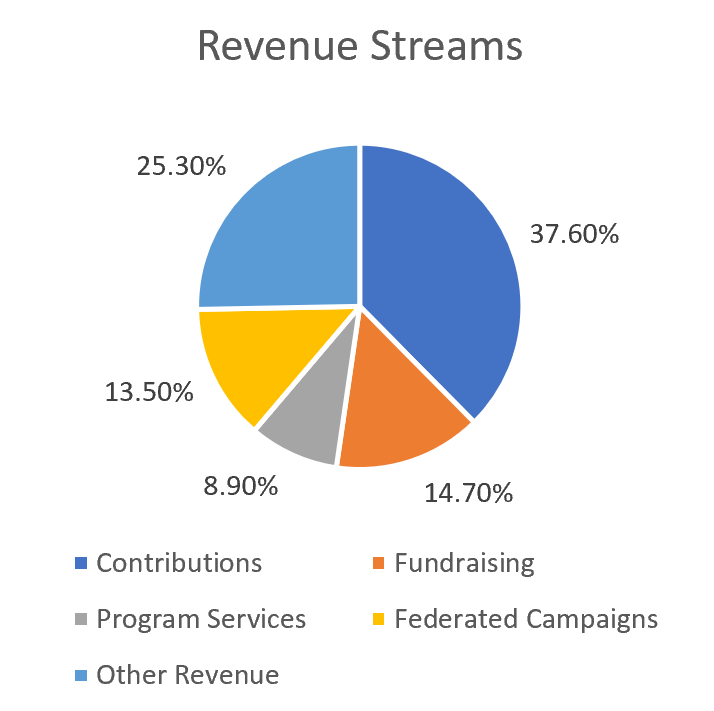

Financial Figures

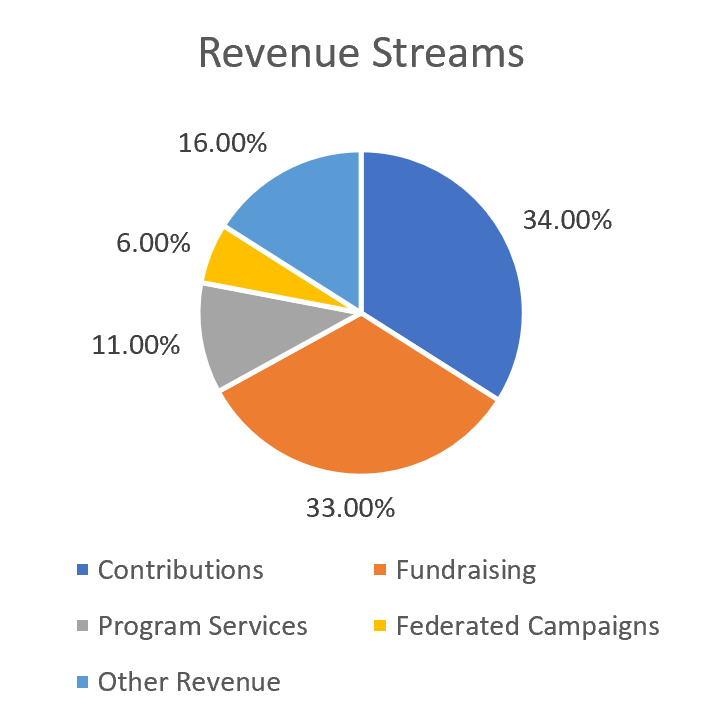

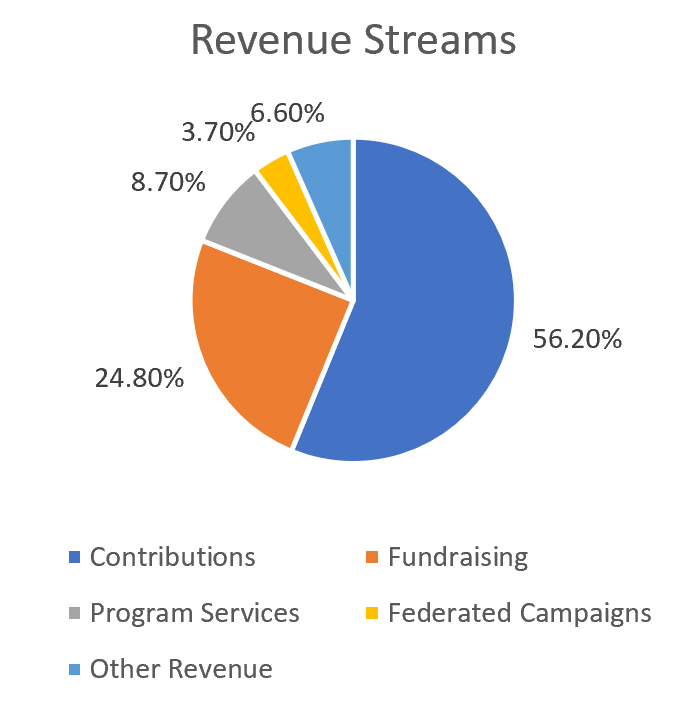

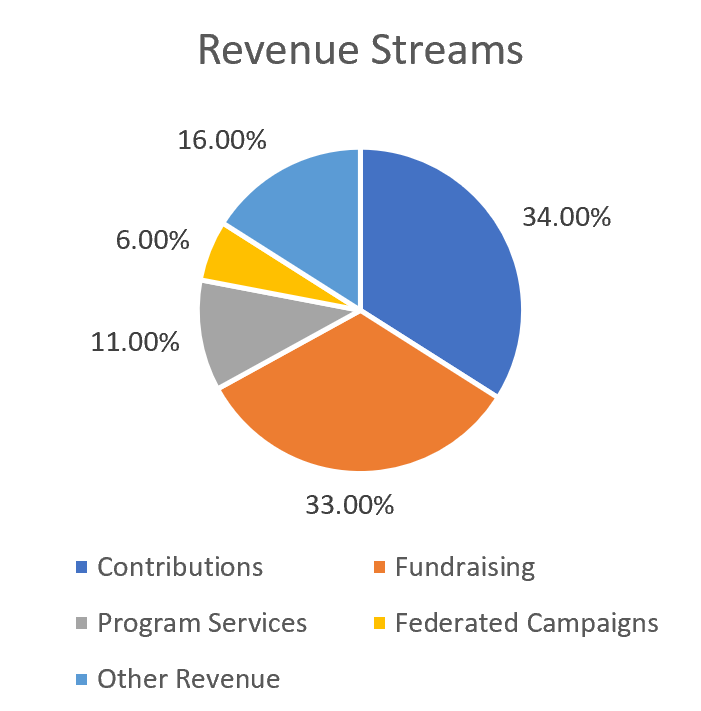

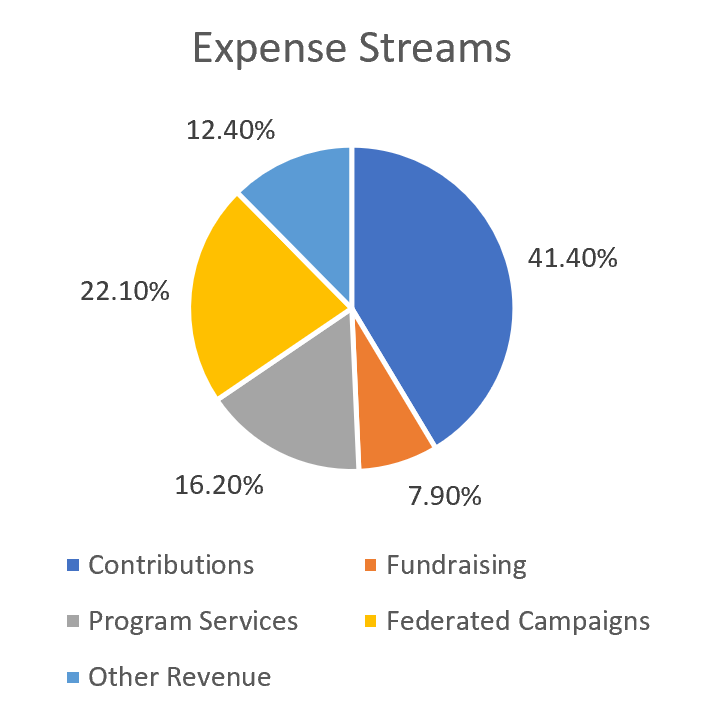

Revenue Streams

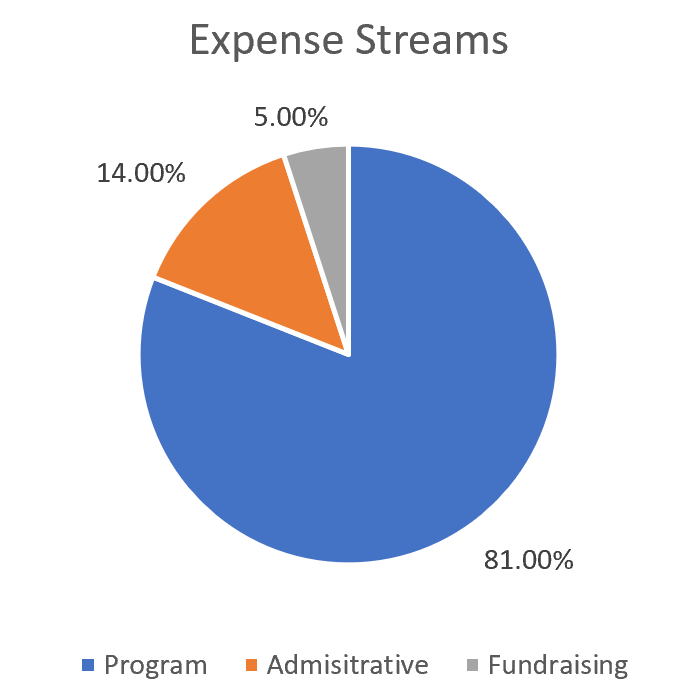

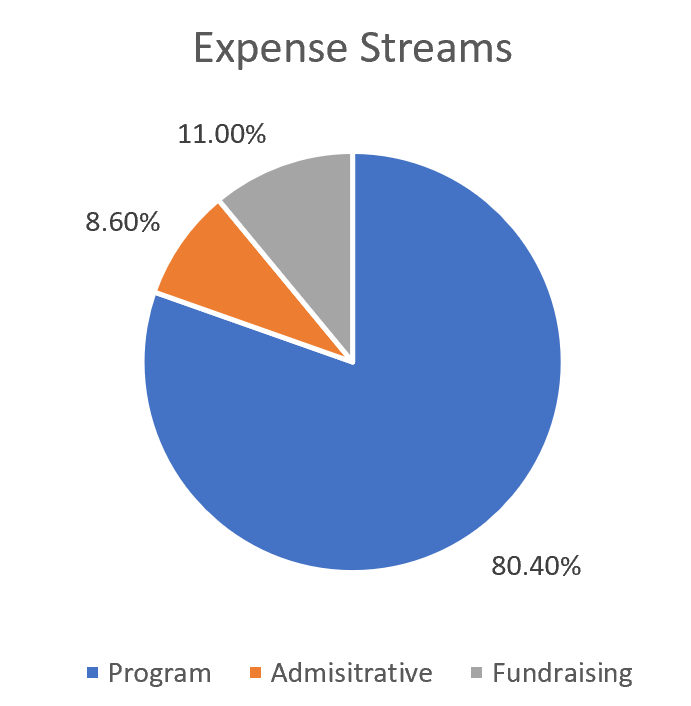

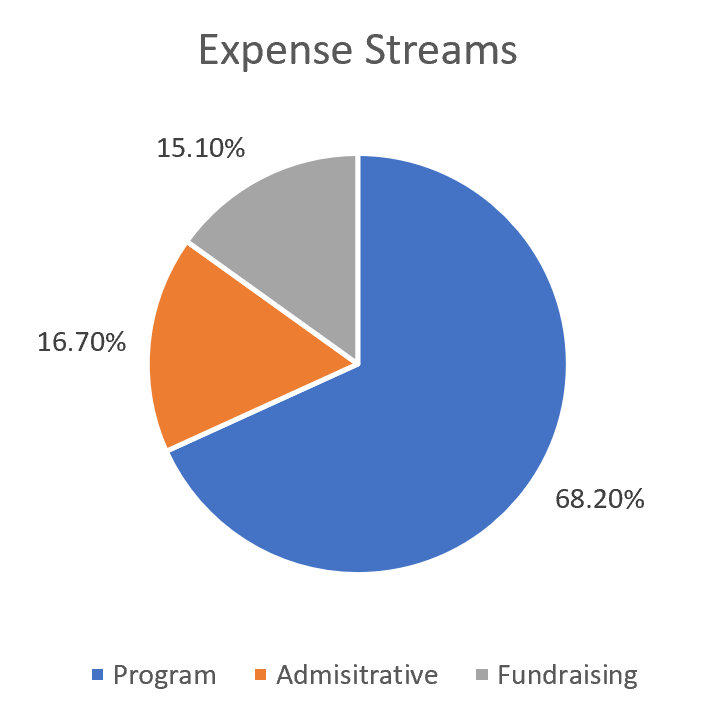

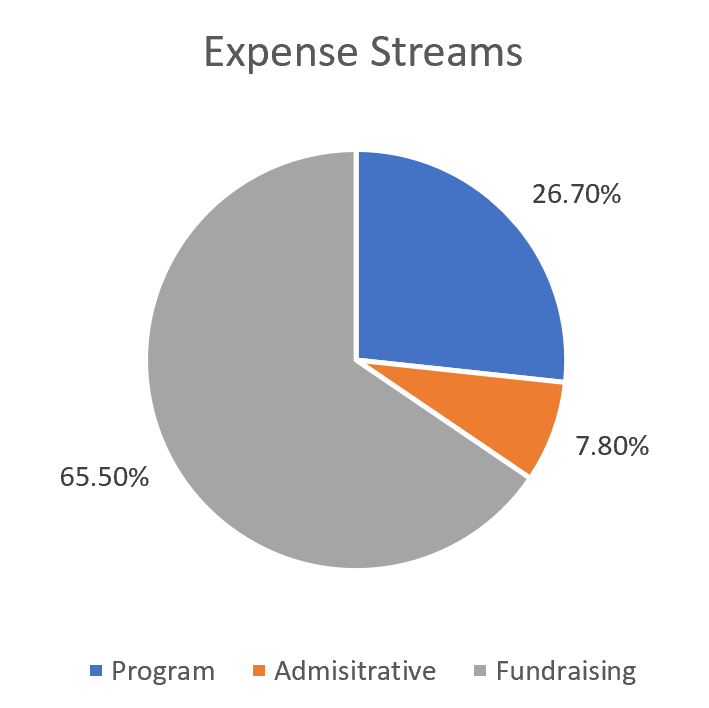

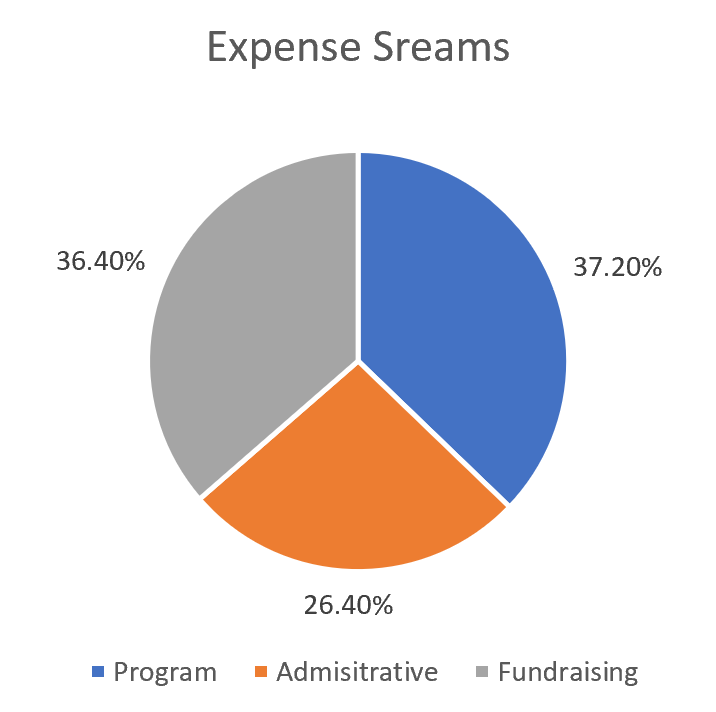

Expense Streams

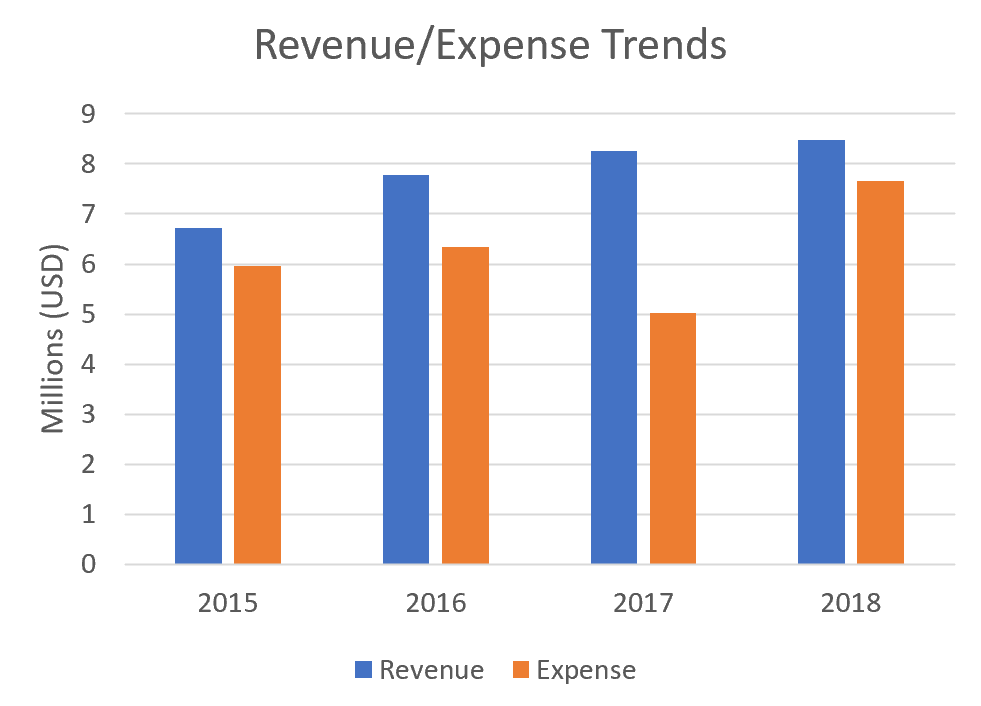

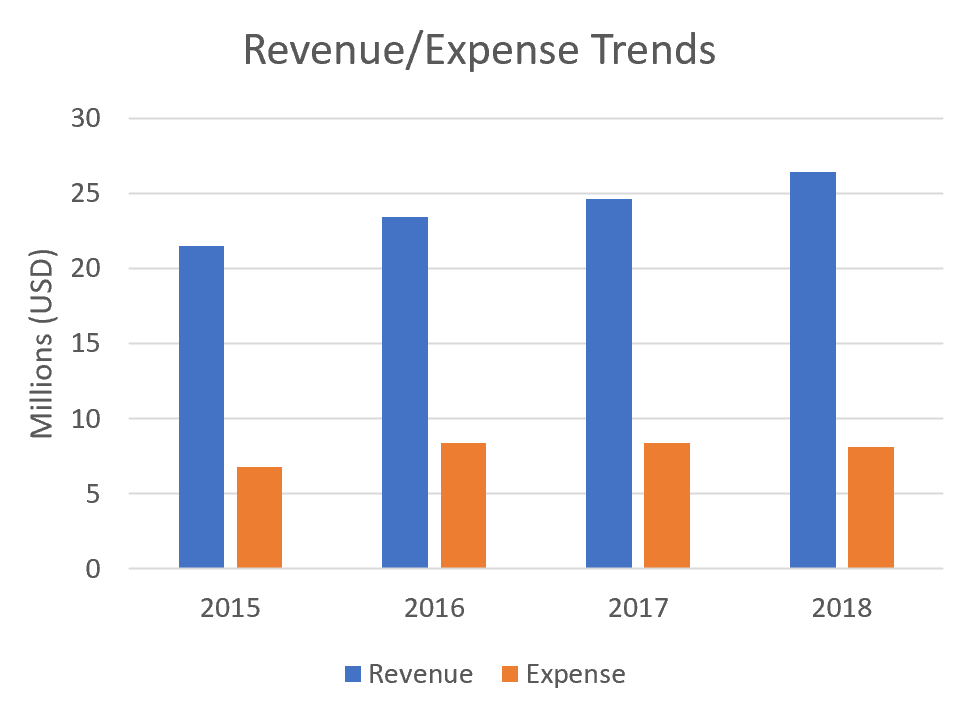

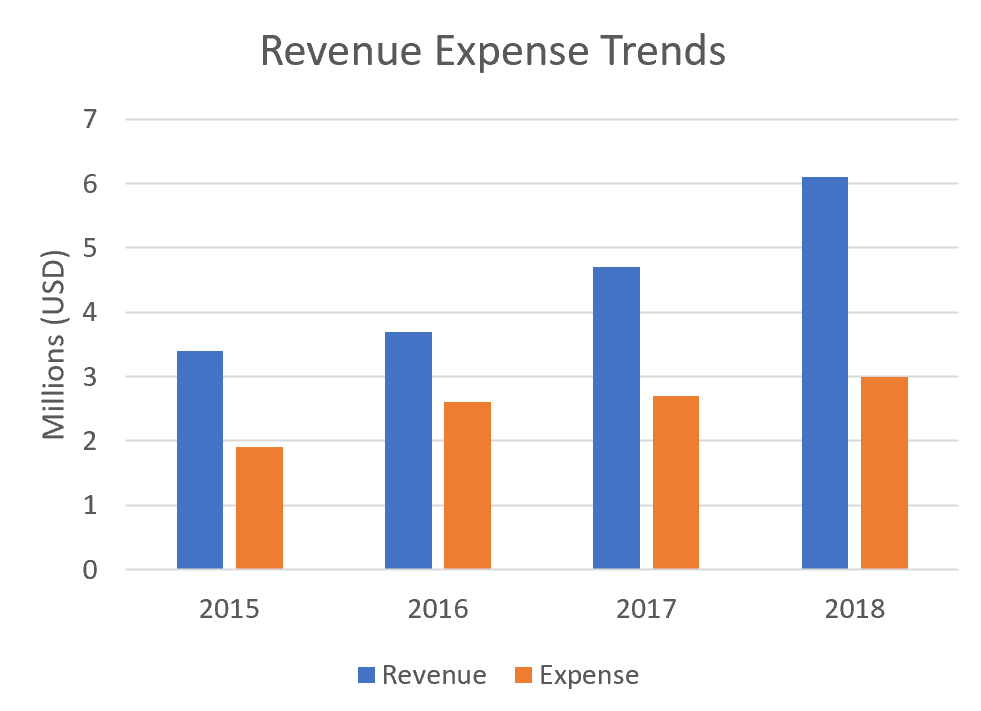

Revenue/Expense Trends

Contact Information

TGR Foundation, A Tiger Woods Charity

121 Innovation Drive

Suite 150

Irvine, CA 92617

tel: (949) 725-3003

EIN: 20-0677815

Financial Report

Fisher House Foundation

North America

$66,795,234

$84,86,486.00

72.00%

11.22 Years

Mission

Use Placeholder Paragraph

Financial Summary

Program Expenses:

$45.2% ($31,256,764)

Total Expenses:

81.2% ($54,943,648)

Fundraising Efficiency:

.28

Working Capital:

11.22 Years

Expense Growth:

14.6%

Revenue Growth:

9.1%

Liabilities to Assets:

11.9%

Income Statement Summary

(FYE 09/2018)

REVENUE

Contributions

Contributions, Gifts & Grants

$41,234,786

Federated Campaigns

$14,468,132

Membership Dues

$0

Fundraising Events

%1,864,416

Related Organizations

$9,468,136

Government Grants

$3,483,457

$56,486,213

1864886

9486321

12464789

26456896

EXPENSES

Program Expenses

11746182

Administrative Expenses

4561946

Fundraising Expenses

1789465

8486486

464153

3467649

121236846

Administrative Compensation

(FYE 09/2018)

245846

68%

Todd Barring

President, CEO

'$687,941

$212,465

.56%

Stacy Jones

Senior Vice President

'$48,643

'$164,649

.53%

Michael Bacher

VP Operations

12,846

184434

.47%

Jaqueline Lang

VP Finance

0

Other Salaries of Note

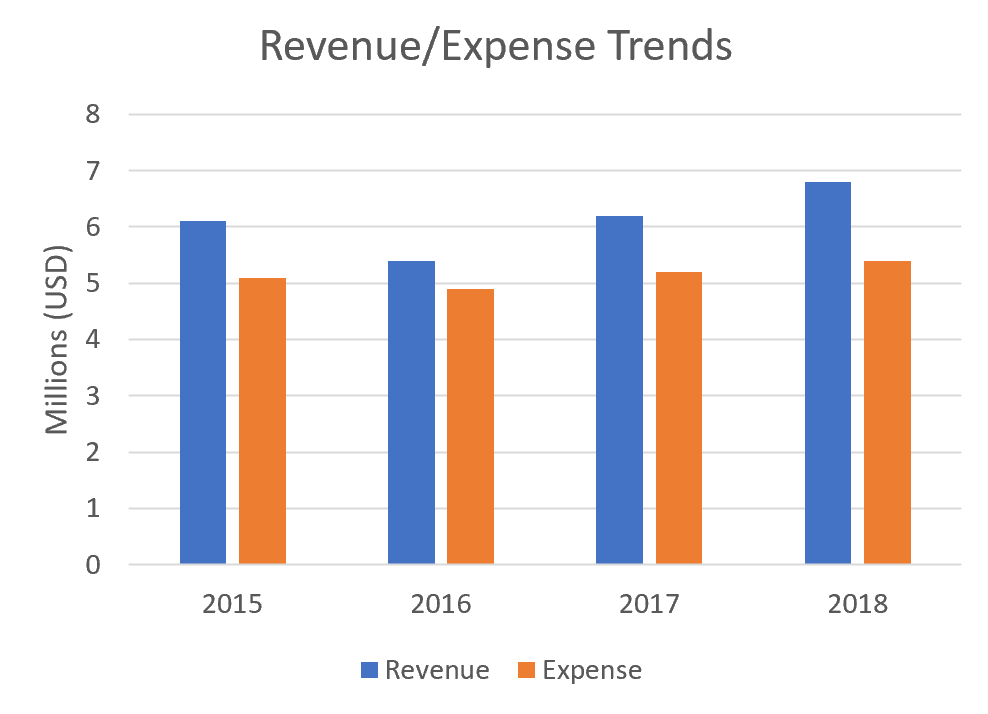

Financial Figures

Revenue Streams

Expense Streams

Revenue/Expense Trends

Contact Information

Andy Roddick Foundation

8509 FM 969

Building 509

Austin, TX 78724

tel: (512) 298-1960

EIN: 20-0014500

Financial Report

Andy Roddick Foundation

North America

$4,765,844

$39,76,471.00

83.00%

6.85 Years

Mission

Use Placeholder Paragraph

Financial Summary

Program Expenses:

$22.8% ($883,423)

Total Expenses:

71.8% ($2,176,431)

Fundraising Efficiency:

.17

Working Capital:

6.85 Years

Expense Growth:

12.5%

Revenue Growth:

11.4%

Liabilities to Assets:

8.1%

Income Statement Summary

(FYE 09/2018)

REVENUE

Contributions

Contributions, Gifts & Grants

1662820

Federated Campaigns

857064

Membership Dues

0

Fundraising Events

12346

Related Organizations

1213550

Government Grants

$0

1156940

31764

2947995

3184965

1466483

EXPENSES

Program Expenses

3390786

Administrative Expenses

992864

Fundraising Expenses

843657

6976471

26486

1758282

12416921

Administrative Compensation

(FYE 09/2018)

168550

1.28%

Michael Barnes

President, CEO

156448

142658

1.15%

James Marks

VP Operations

14655

88465

.86%

Erica Mathews

VP Marketing

5620

72955

.74%

Vincent Mallah

VP Domestic Programs

0

Other Salaries of Note

Financial Figures

Revenue Streams

Expense Streams

Revenue/Expense Trends

Contact Information

Andy Roddick Foundation

8509 FM 969

Building 509

Austin, TX 78724

tel: (512) 298-1960

EIN: 20-0014500

Financial Report

Georgia Transplant Foundation

North America

$7,346,123

$56,13,448.00

69.00%

7.8 Years

Mission

Use Placeholder Paragraph

Financial Summary

Program Expenses:

$33.7% ($3,346,464)

Total Expenses:

62.8% ($5,497,312)

Fundraising Efficiency:

.31

Working Capital:

7.8 Years

Expense Growth:

14.7%

Revenue Growth:

7.6%

Liabilities to Assets:

11.4%

Income Statement Summary

(FYE 09/2018)

REVENUE

Contributions

Contributions, Gifts & Grants

1264264

Federated Campaigns

764332

Membership Dues

0

Fundraising Events

1056466

Related Organizations

1213550

Government Grants

$0

1946731

846231

3468124

3134682

1564327

EXPENSES

Program Expenses

4846869

Administrative Expenses

842866

Fundraising Expenses

942655

5613448

345566

1112432

8134617

Administrative Compensation

(FYE 09/2018)

186447

1.33%

Eric Dach

President, CEO

122745

151864

1.21%

Tonya Johnson

VP Finance

49499

94765

1.01%

Matthew O'Donell

VP Global Affairs

0

816497

0.97

Martin Jensen

VP Operations

0

Other Salaries of Note

Financial Figures

Revenue Streams

Expense Streams

Revenue/Expense Trends

Contact Information

Georgia Transplant Foundation

2201 Macy Drive

Roswell, GA 30076

tel: (770) 457-3796

EIN: 58-207519

Financial Report

Lone Survivor Foundation

North America

$6,788,645

$31,65,336.00

77.00%

14.2 Years

Mission

Use Placeholder Paragraph

Financial Summary

Program Expenses:

$57.3% ($3,468,137)

Total Expenses:

62.8% ($5,613,614)

Fundraising Efficiency:

.23

Working Capital:

14.2 Years

Expense Growth:

13.9%

Revenue Growth:

9.7%

Liabilities to Assets:

6.4%

Income Statement Summary

(FYE 09/2018)

REVENUE

Contributions

Contributions, Gifts & Grants

126084

Federated Campaigns

234332

Membership Dues

0

Fundraising Events

1056466

Related Organizations

1643550

Government Grants

651344

1156940

286147

1364927

2346847

1746623

EXPENSES

Program Expenses

7648362

Administrative Expenses

1256645

Fundraising Expenses

1378895

3165336

46848

864621

7616485

Administrative Compensation

(FYE 09/2018)

205647

1.18%

Mark Mantrell

President, CEO

64721

142965

1.21%

Kenneth Windrow

Vice President

62475

128467

1.16%

Richard Deltoro

VP Veteran Affairs

0

121828

1.12

Patricia Atkins

VP Operations

0

Other Salaries of Note

Financial Figures

Revenue Streams

Expense Streams

Revenue/Expense Trends

Contact Information

Georgia Transplant Foundation

2201 Macy Drive

tel:

EIN:

Financial Report